Adyen: The Complete Payment Solution – An In-Depth Review

Adyen, a global payment company, has revolutionized the way businesses handle transactions. This comprehensive review explores the inception, functionality, application, effectiveness, future potential, and success stories of Adyen’s payment technology.

Introduction to Adyen: Origins and Overview

Founded in 2006, Adyen emerged as a response to the growing need for a unified payment system that could facilitate seamless transactions across various channels and borders. Adyen’s platform was designed to offer businesses a single solution for accepting payments worldwide, cutting through the complexity of the fragmented payment landscape.

Adyen’s approach has been to simplify the payment process, offering a single platform that integrates different payment methods, fraud management, and other financial services, thus providing a comprehensive payment solution for businesses of all sizes.

How Adyen Works and Its Applications

Payment Processing and Integration

Adyen’s platform processes payments across online, mobile, and in-store channels. It supports a wide range of payment methods, including credit cards, mobile wallets, and local payment solutions. Its API integrations allow for seamless incorporation into existing business systems.

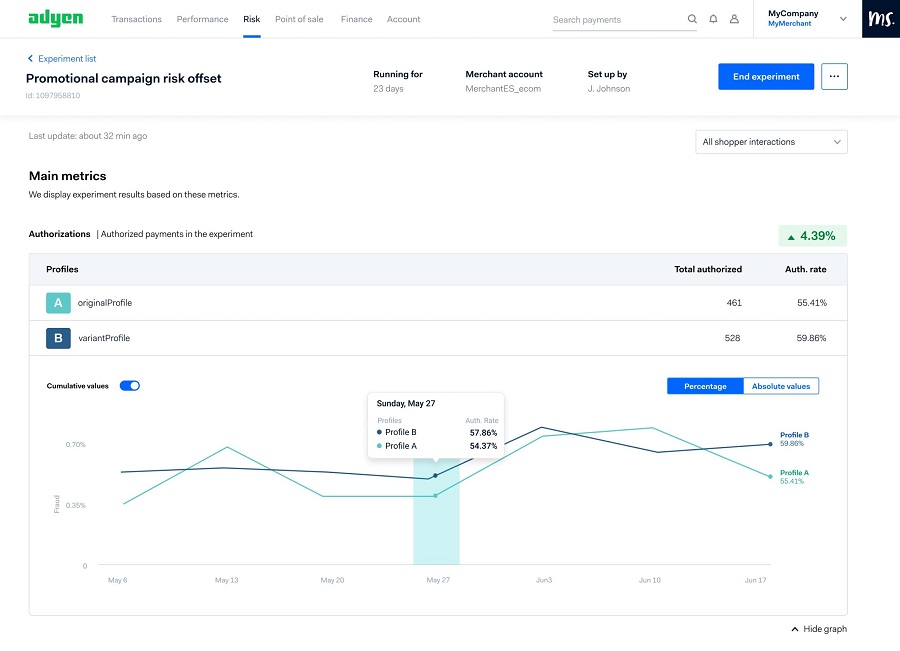

Fraud Prevention and Risk Management

Alongside payment processing, Adyen offers advanced risk management tools and fraud prevention algorithms. These tools help businesses minimize risks associated with online transactions while maintaining a smooth payment experience for legitimate customers.

Data Analysis and Reporting

Adyen also provides detailed analytics and reporting features, enabling businesses to gain insights into payment performance, customer preferences, and market trends, thereby aiding in informed decision-making.

Global Adoption of Adyen’s Technology

Adyen’s technology is utilized worldwide by a diverse range of industries including retail, gaming, travel, and more. Its ability to handle various currencies and payment methods makes it particularly attractive for global businesses.

In regions like Europe, Asia-Pacific, and the Americas, Adyen has become a go-to solution for companies seeking a robust and versatile payment platform.

The Effectiveness of Adyen’s System

Adyen has been praised for its high transaction success rates and its ability to reduce payment friction. Its unified platform streamlines the payment process, resulting in better customer experiences and increased sales for businesses.

Furthermore, its robust security measures and fraud detection capabilities have significantly reduced the risk of fraudulent transactions, instilling confidence among its users.

Future Perspectives and Trends in Payment Technology

Looking ahead, Adyen is well-positioned to capitalize on trends like mobile payments, AI in fintech, and the growing emphasis on cross-border e-commerce. Its continuous innovation in payment technology aligns with the evolving demands of the digital economy.

Adyen’s commitment to expanding its feature set and entering new markets suggests a promising future for this payment solution.

Success Stories: Adyen in Action

Many renowned companies have successfully integrated Adyen’s payment system, reaping benefits like increased conversion rates, reduced fraud, and improved customer satisfaction. From large-scale e-commerce platforms to emerging startups, Adyen’s impact has been widely acknowledged.

These success stories highlight Adyen’s capability to cater to diverse business needs, solidifying its reputation as a leading payment solution provider.

Conclusion: Adyen’s Role in Modern Payment Solutions

In conclusion, Adyen justifies its position in the market by offering a comprehensive, efficient, and secure payment solution. Its adaptability, global reach, and continuous innovation make it a valuable asset for any business looking to streamline its payment processes.

As the digital economy continues to evolve, Adyen’s role in facilitating smooth and secure transactions is likely to become even more crucial.